Author: Annette Malave, SVP/Insights, RAB

Purchasing or leasing a vehicle remains one of the events in life that consumers either look forward to or dread. There are so many options and considerations that can be overwhelming, and the current economic landscape and events can make it more challenging for auto-intending consumers to decide and commit.

Due to continued supply and demand issues, vehicle costs remain at the forefront of the decision-making process. Twenty-seven percent of adults plan on cutting back on their auto spending due to these issues and specifically, 29% of those who plan to cut back have been impacted by shortages when visiting a new car dealership, per CivicScience data.

So how much are consumers willing to spend on new vehicles? A recent Cox Automotive report showed that that the average market price for a new vehicle (Jan-June 2023) was $1,321 higher than what consumers are willing to pay. That difference is even greater for used vehicles at nearly $2,000.

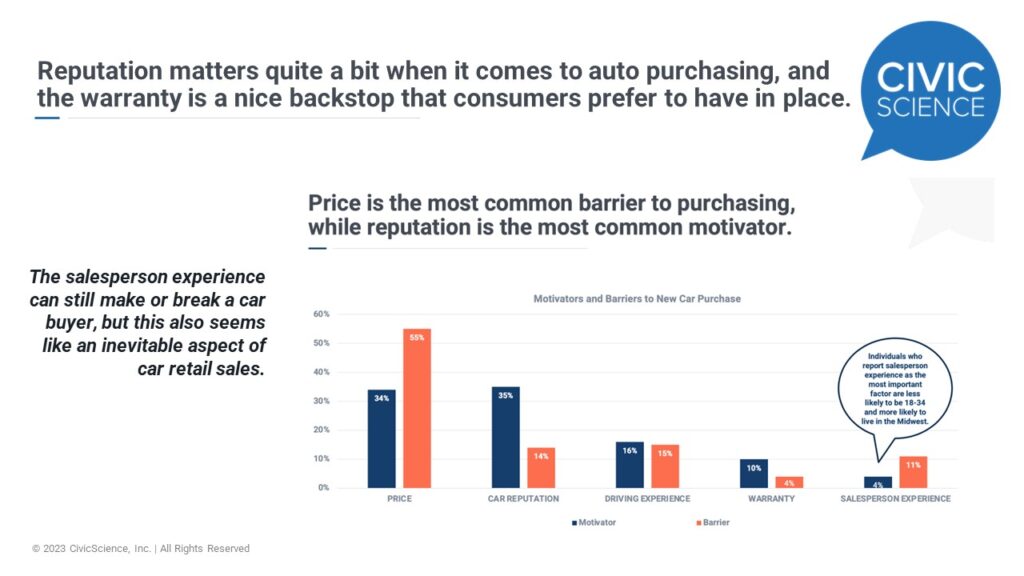

Price has always been and probably always will be a top factor in vehicle purchase decisions. Auto dealers should look to what motivates buyers to make the purchase and incorporate some of that into their ad messaging. CivicScience data found that vehicle reputation was the top motivator for vehicle selection followed by price. Anecdotally, we know that dealership reputation also weighs in. What is surprising is that a vehicle’s warranty is also a motivator. Of course, the actual experience matters, so salespeople at dealerships may make or break that sales opportunity.

Despite all these shifts challenges, 2023 auto buyers look similar to those buyers of 2019. They regularly dine at upscale restaurants, are sports fans, are employed full-time earning $100K and are married. These are just some of their characteristics.

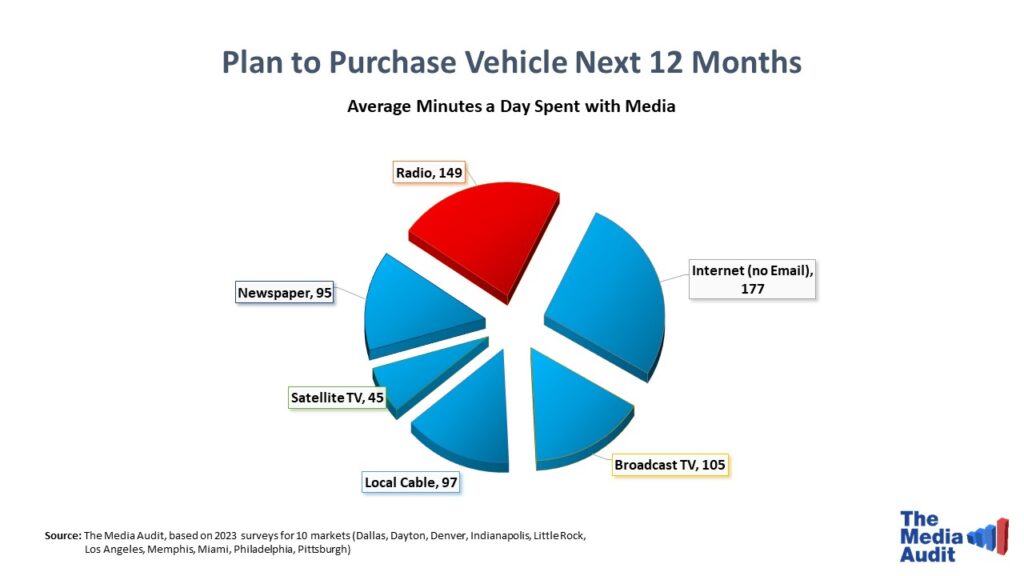

As the original mobile medium, auto dealers should use broadcast radio as they map out their advertising strategies. Adults who plan to purchase a vehicle within the year spent more time with broadcast radio compared to other traditional media like TV or newspapers.

Radio listeners are prime targets for auto sales. Sixty-two percent of adult radio listeners have purchased their vehicle from a dealership or manufacturer. And having a car that works well for their entire family is what matters to 86% of radio listeners, per MRI-Simmons.

Driving traffic to dealership sites matters – whether those sites are brick and mortar or online. Tapping into what resonates most with consumers who are in the market to buy or lease a vehicle and using a medium with prime leads, like radio, should be on every auto dealer’s marketing plan.