Author: Annette Malave, SVP/Insights, RAB

What a difference a few years make. We have all seen it and experienced it. Although different, business is back from the impact of the pandemic. Shelves are full and automotive dealer lots are full. Automotive has gone from a seller’s market to a buyer’s market.

By Q4 2023, there were 288.5 million vehicles on the road. According to Experian, over 15 million new vehicles were registered, and over 38 million used vehicles changed ownership.

Vehicle purchases in 2023 were prompted by various reasons – for both new and used vehicle buyers. The top reason for both was that the vehicle was older. When it came to the next two reasons, there were differences among new and used buyers. According to Cox Automotive’s 2023 Cary Buyer Journey Study, 23% of new buyers wanted a vehicle with certain features follow by the need or want for a different vehicle type. For used buyers, unrealiabilty (25%) followed by the need or want of a different vehicle (19%).

Like the improved inventory situation at dealerships, consumers are also having better experiences during their shopping journey. Consumers are much more satisfied with their shopping experiences and even more so with the dealer experience. Dealers use of various tools and services have improved the entire shopping and purchasing process.

With increased automotive inventory levels, dealers have found themselves with a greater need to advertise. Ad budgets in 2023 have significantly increased compared to 2022 ($8.9B versus $8.57B). And when it came to share of budget, broadcast radio saw a positive influx of dollars increasing to 9.5% in 2023 compared to 7.8% in 2022.

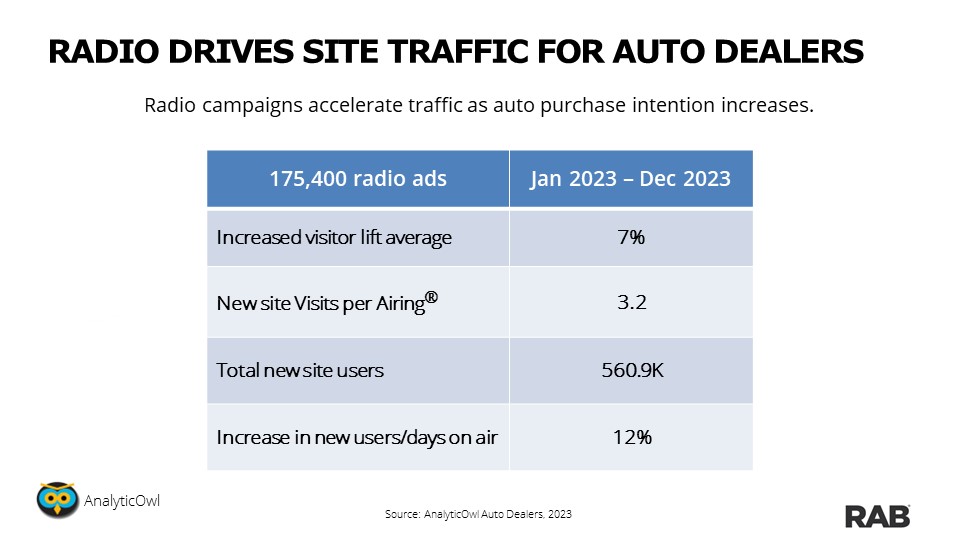

As dealers work to reduce inventory levels and increasing sales, broadcast radio can accelerate activity for dealer websites. Based on an analysis of over 175 thousand radio ads in 2023, radio campaigns drove increased website activity by 7%. Using data from AnalyticOwl, AM/FM radio also increased new site visitors 12% for every day the campaign radio spots aired.

When it comes to search, we know that consumers are constantly online doing their research. For automotive, this couldn’t be more true. Exposure to radio campaigns drives activity for new site visitors throughout the week but that exposure prompted greater web lift towards the weekend. When it comes to dayparts, Midday drove the highest number of new users for each spot aired, followed by Afternoon.

Radio matters and it helps drive messaging to auto buying intenders. Radio reaches over 81% of adults who plan to buy a vehicle – compact, full size, hybrid or SUV, per Scarborough. Using radio puts the pedal to the metal for auto dealers.

You can view the full analysis here.