Contributor: Nicole Ovadia, vice president of forecasting and analysis, BIA Advisory Services

The radio advertising landscape is in the midst of a dynamic transformation, but within this evolution lies a world of untapped potential. As consumer habits adapt and digital integration becomes the norm, key industries are reshaping their advertising strategies. Yet, amidst these changes, local radio stands strong as a resilient and potent force in the media mix – the fifth largest media when you examine the total local advertising marketplace.

Radio is Resilient

Local radio is poised for a resilient year. With a 1.8% increase over 2023, we project that radio’s ad revenue will climb to $13.6 billion (Radio OTA + Radio Digital1) in 2024. Looking to 2025, BIA estimates local radio will generate $12.9 billion, with $2.9 billion coming from radio digital.

Tracking the Growth

For 2024, an election year like no other, unsurprisingly political advertising will lead local radio ad spending in 2024 with just over $631 million – well over 2020’s $517.9 million. For Radio OTA, Political is the number one spending category at $561.2 million.

Other traditionally radio-focused verticals round out the top five in 2024, including Investment & Retirement Advice, Quick Service Restaurants (QSRs), Commercial Banking and Supermarkets.

Looking ahead to 2025, there will be shifts especially with limited political dollar influx. Quick Service Restaurants (QSRs) emerge as the top spender at $558 million. Investment & Retirement Advice, Supermarkets, Commercial Banking and Hospitals round out the top five spending ad categories that will contribute to Radio OTA growth.

Radio Digital Growing

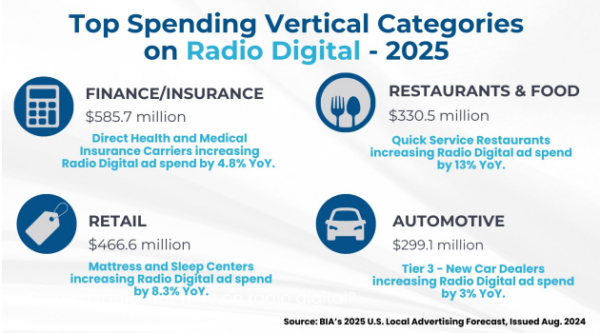

As broadcasters continue to expand their portfolio of services and products, interesting trends begin to form within the Radio Digital sector. It’s a growth medium for key ad categories in local markets in 2025.

The Finance/Insurance category will be the spending leader for Radio Digital with $586 million in local ad spend. Other categories that will significantly increase their spend in Radio Digital in 2025 are QSRs (+13.3 percent), Supermarkets & Other Grocery Stores (+5.9 percent) and Tier 3 – New Car Dealers (+3.0 percent).

What the Crystal Ball Says About Audio Advertising

We have our eye on a few key industry activities: 1) recently FCC-approved over-the-air geotargeting with content-originating boosters – this could be a game changer, and 2) the inclusion of CTV and video ads to offset spot ads. In a recent RAB study, it was reported that advertisers that buy ads from radio stations also purchase CTV from them, offering tremendous opportunity for local sellers.

Finally, with radio’s evolution continuing, tapping into opportunities available with Radio OTA and Radio Digital can advance the revenue and sales opportunities for the industry as well as advertisers. Radio’s value is proven and tangible and it’s up to us to use innovative solutions to deliver content and increase engagement with listeners in local markets to navigate the ever-evolving landscape.

1Radio Over-the-Air (OTA):All revenues generated by local radio stations for sale of time to either national or local advertisers from their over-the-air broadcasts. This does not include any advertising sold by the national radio networks.

Radio Digital: Digital radio advertising includes local advertising sold by local stations (streaming, email advertising, O&O banners, SEM (not SEO), website advertisements) and pure play streaming services except CTV/OTT. Includes the share retained by local radio stations after reselling other online platforms (e.g., Google AdWords).