Author: Annette Malave, SVP/Insights, RAB

Throughout 2020, eyes became the focal point of expression and connection. In some instances, adults used makeup to accentuate their eyes impacting eye makeup sales. According to a Kantar analysis, while the total cosmetics category experienced usage declines in 2021, eye makeup was less severely impacted.

Prior to the pandemic, many consumers took facial expressions and overall skincare for granted. As we engaged with others, we would see their entire face – it was easy to recognize someone. As we all know, that changed as masks were donned. Women increased their use of eye makeup and both men and women recognized the importance of skincare, mostly due to maskne. (Maskne is a term used to describe acne or rosacea flare-ups, etc., created due to the bacterial imbalance caused by wearing a mask for extended periods of time.)

When it comes to makeup and skincare, both men and women will spend money to look their best. A survey released prior to the pandemic by Groupon reported that women spend $313 monthly on their appearance, while men spend $244. As it relates to makeup and skin care, women spent most on facials, makeup and other items, while men spent it on facial moisturizers, hand creams, shaving products and other items. These are items that are readily available at national and local retailers – from major department stores to local pharmacies and retailers.

As Americans across the country start to feel more at ease, masks are becoming a rarity and skincare and makeup have returned. In the past month, 36% of American adults purchased beauty supplies – a sales opportunity for retailers. As noted earlier, this category appeals to both sexes. According to Provoke Insights, a full-service market research firm, these beauty supply shoppers are only more likely to be female, are of mixed ethnicity and would pay more for sustainably sourced items. When it comes to skincare, 44% of adults purchased skincare in the past month.

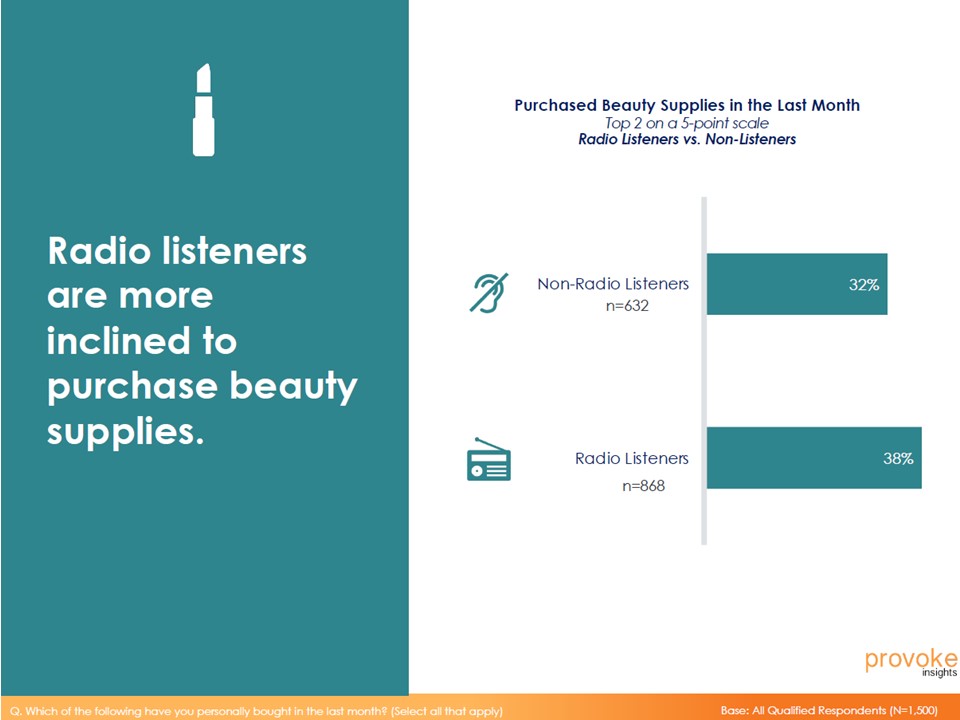

Retailers who sell these products not only have an opportunity due to increased use, but when using radio, those sales opportunities can be positively impacted. Why? Radio listeners are more inclined to have purchased beauty supplies and skincare supplies in the past month compared to nonradio listeners. Based on a Provoke Insights survey, looking at the top two on a five-point scale, 38% of radio listeners purchased beauty supplies versus nonlisteners (32%), and 45% purchased skincare compared to nonlisteners (42%).

Radio listeners prefer to shop at brick-and-mortar locations. Retailer messaging should incorporate points that matter to shoppers, availability and brands to help drive in-store traffic. Sixty-seven percent of radio listeners purchase their beauty supplies in-store versus via an e-commerce site (22%), and 65% purchase their skincare needs at the physical location. Noting brands is also important to radio listeners as they are brand loyal. Forty-two percent of radio listeners are not open to purchasing new beauty supply brands, and 44% will not consider buying a different skincare brand.

Radio listeners who purchase beauty supplies and skincare are an opportunity for retailers. They are local consumers who prefer the in-store shopping experience. It is not just about how someone’s eye look anymore, but more about what they can see when they buy.

Do you know of any manufacturers that co-op or any accessible retailers that are not national accounts for Local sellers?

Hi Jim, Thanks for your question. Via our co-op tool, I would suggest that you use the term makeup and it should produce some co-op leads. You may also want to look at some of your local boutique natural stores that may have soaps, lotions, etc. that aren’t part of a national brand. The growth behind all natural and locally sourced “clean” beauty brands is booming!