Author: Annette Malave, SVP/Insights, RAB

The restaurant industry has had to juggle a few plates in the past few years, and some of that juggling continues today. Inflationary food costs, competition and patron expectations are just some of the challenges restaurants are experiencing.

The food service industry (aka restaurants) is estimated to experience revenue growth in 2023 to $997 billion. Some of this growth can be attributed to increased menu prices driven perhaps by higher food costs. The industry continues to experience some staffing issues, although not as great as 2022. Nearly half of all restaurant owners believe that competition in 2023 will intensify. These are just some of the challenges uncovered within the National Restaurant Association’s (NRA) 2023 State of the Industry report.

Consumers value and appreciate restaurants and probably more since lockdowns. Per the NRA, 64% of consumers consider restaurants as essential to their lifestyle, and 55% feel the same about takeout and delivery.

Like restaurant owners, inflation is a concern for consumers. Sixty percent of adults 21-65 years of age see inflation as a top concern. When it comes to radio listeners, 65% see inflation as a top concern. But radio listeners are savvy and strategic in how they save money. Forty-two percent of radio listeners have begun to track their spending in the past three months, and 47% have used coupons for any of their purchases. These are just a few of the findings based on findings by Provoke Insights.

Conducted in April of this year, Provoke Insights, a full-service market research firm, analyzed results of radio listeners and nonlisteners. The survey results not only provide a snapshot into the consumer mindset as it pertains to dining choices, but also includes insights that should be considered or incorporated when restaurant operators are trying to maintain and grow their business. Per Scarbrough, radio’s ability to reach potential restaurant diners, whether quick-serve (83%) or sit down (84%) makes it a medium that should be on every operator’s media menu.

Radio listeners are more aware than nonlisteners (85% versus 78%) of restaurant price increases, according to the Provoke Insights analysis. While radio listeners may be dining out less, there are ways to whet their appetites. Seventy-five percent of radio listeners have made dining choices such as selecting cheaper menu items, eliminating appetizers or cutting out desserts. Restaurant operators might consider promoting value meal options or discounts within certain hours to increase their traffic promotional deals and loyalty programs, which resonate and are attractive to radio listeners versus nonlisteners.

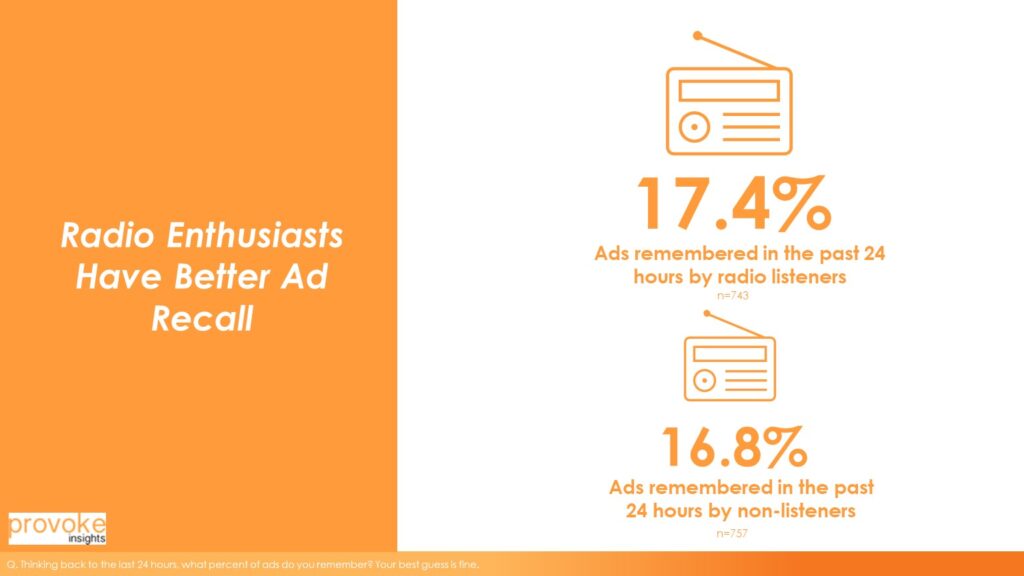

Including options and deals in radio messaging works. Why? Radio listeners have a higher recall of ads they heard than nonlisteners.

No matter how you slice it, radio makes sense and works for restaurants. It increases ad recall and drives traffic.

RAB Members can view the full report here or watch the presentation on demand.